Which Asset Is Not Depreciable Select All That Apply

This distinguishes land from all other asset classes. Land is not depreciated because land is assumed to have an unlimited useful life.

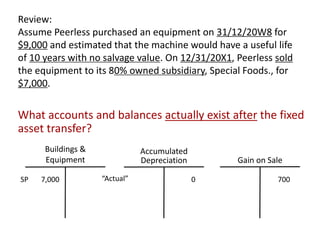

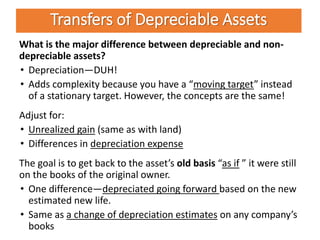

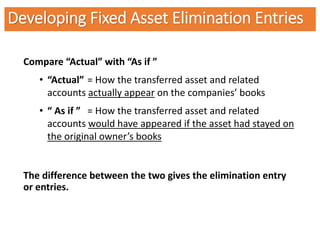

Intercompany Transactions Of Non Current Assets Depreciable Assets

Select all that apply Correct options are.

. Depreciation Year 4 01667 16400 273388. Which question is the basis for determining which one of a set of alternative assets with differing lives is. Instead they are assumed to be converted to cash within a short period of time typically within one year.

Depreciation 4 154005 3080. Flows occur in year 4. What is the depreciation in year 4 273388 Rationale.

Select all that apply - produces an ordinary loss equal to the excess of the tax basis of the assets over any insurance reimbursement. Other long-lived assets such as land improvements buildings furnishings equipment etc. Evan Company sold a depreciable asset this year for 100000.

13200 3080 1760 880 Reason. What is the total cash flow for year 2. Select all that apply.

Aintangible assets held by an entity for sale in the ordinary course of business see IAS 2 Inventories and IAS 11 Construction Contracts. Select all that apply Which of the following statements are true. 101The depreciable amount of an asset with a finite useful life is determined after deducting its residual value.

MACRS uses DDB for 3- to 10-year property and then switches to SL when SL produces a higher depreciation value d. - produces an ordinary loss equal to the fair market value of the assets. The asset type has a depreciation code of NO-No Depreciation Calculated A full disposal exists for the asset.

Select the newly created asset group ID click the Book tab select the book ID select Recalc Remaining and then click Apply Changes. For example this Standard does not apply to. Bdeferred tax assets.

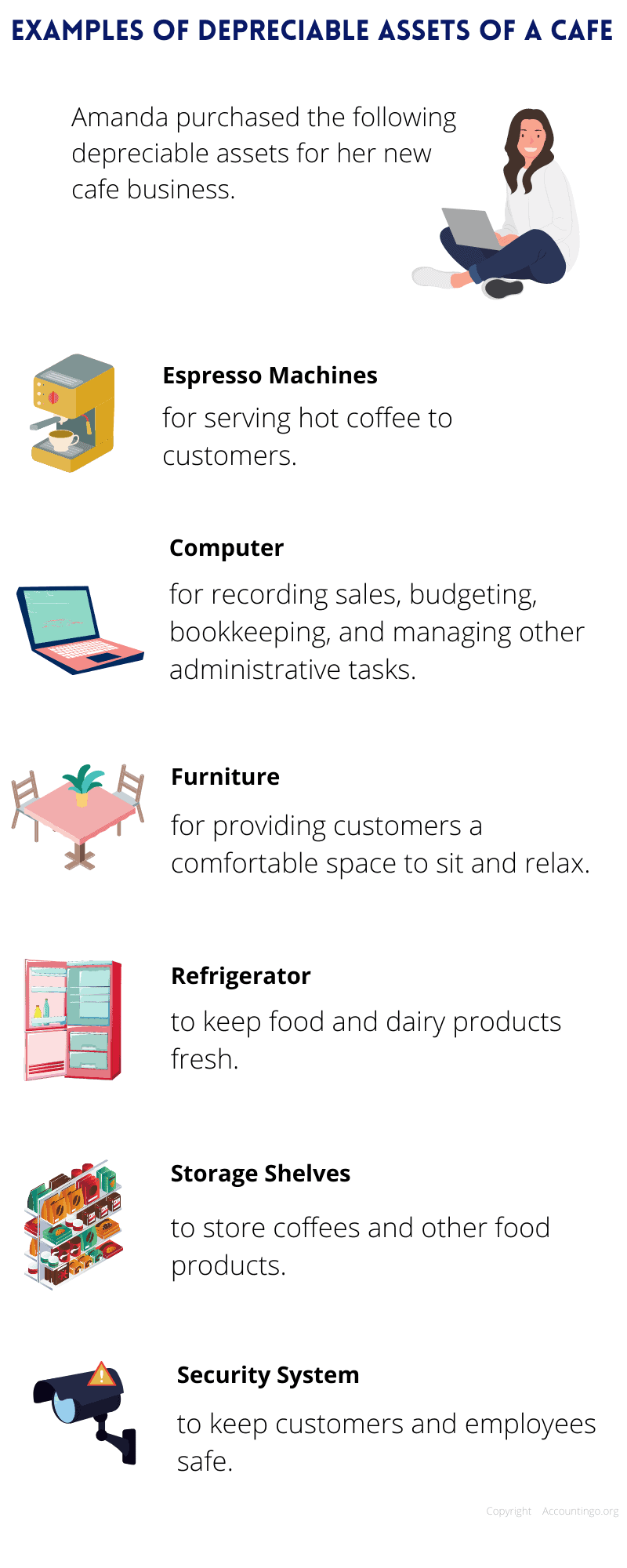

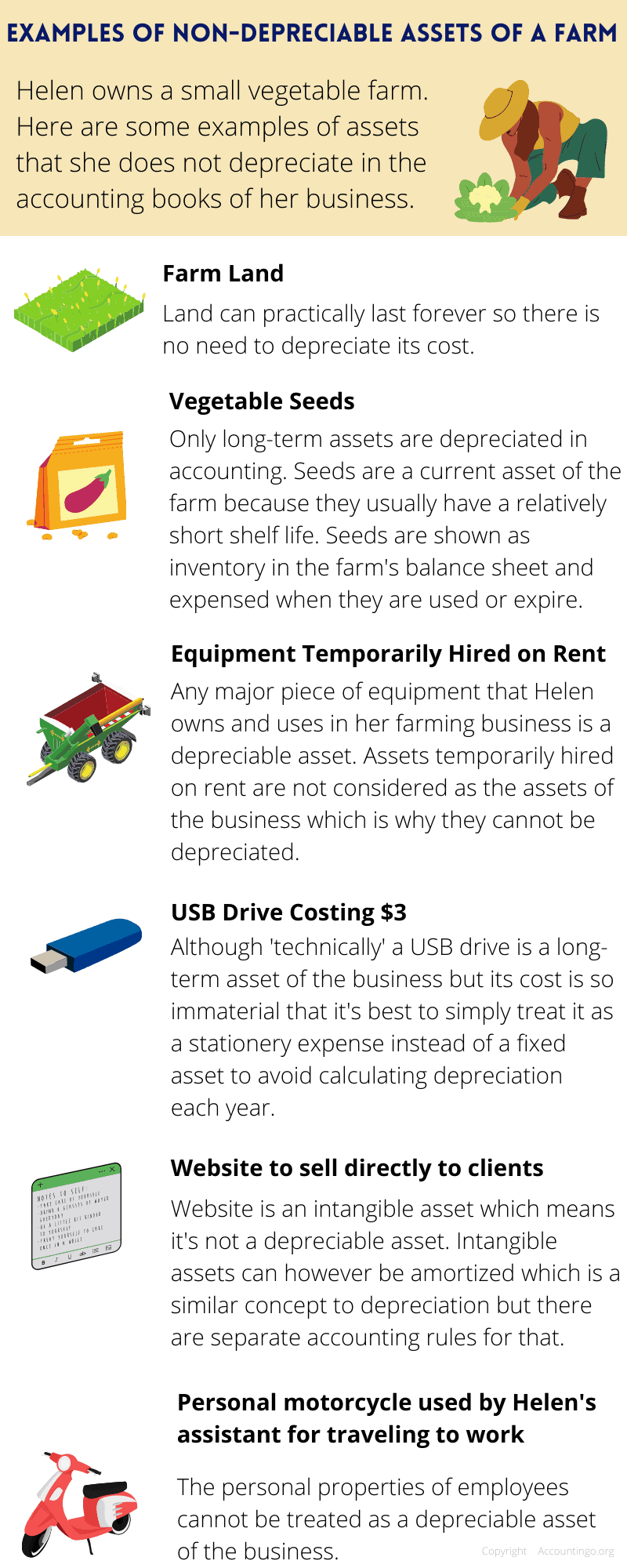

The above assets are classified as depreciable assets because they are primarily used by the business and wear out with time land is not considered a depreciable asset since it naturally appreciates in value over time. The cost of equipment purchased along with its residual values and estimated lives by type of equipment are as follows. Current assets such as accounts receivable and inventory are not depreciated.

However land in and of itself is not depreciable. The average useful life for straight-line depreciation for buildings and improvement is 15-44 years and 5-15 years for machinery and equipment. Click Transactions point to Fixed Assets and then click Mass Change.

Accounting questions and answers. The cost to replace the asset at the end of its useful life. The asset had a book basis of 65000 and a tax basis of 53000.

The majority of fixed assets are also depreciable assets but there are exceptions. MACRS uses the 150 declining balance method with SL switchover for all assets c. Multiple choice question.

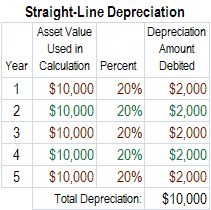

Are there fixed assets that are not depreciable assets. In Year 1 Orange Company determines that it will depreciate its equipment using the group method. Given straight-line depreciation with half- year convention.

Select all that apply Inventory Artistic compositions held by their creator. Evans booktax difference from this sale is. You also cant depreciate assets that are purchased and disposed of in the same year otherwise known as current assets Current assets include certain supplies prepaid insurance and accounts receivable amounts owed to your business.

Explanation - Land is fixed assets but it is not depreciable because land has inifinte. A casualty or theft of business assets. Once youve tested the steps above try depreciating all assets again.

Because land is a long-term asset with no depreciation its value cannot be depreciated over time. Select all that apply a. The asset has the Zero Book Value check box selected.

An asset has a 3-year life and a depreciable basis of 16400. The asset is being used in another calculation for the current Depreciation Date. Given their low cost it is not cost-effective to maintain.

Note that an asset that is NOT eligible for tax and accounting purposes to register depreciation in compliance with Internal Revenue Service IRS rules is. All of the MACRS percentages found in the IRS tables are applied to an assets initial depreciable basis b. It is the only one that does not allow for depreciation.

- may result in no deductible loss if the assets are insured for more than their tax basis. The existing asset will be fully depreciated in year 3 so there is no foregone depreciation in year 4. Which of these assets are not depeciated select all tha apply 1 machinery 2buildings 3 land 4equipment 5 cash 6inventory.

In addition low-cost purchases with a minimal useful life are charged to expense at once rather than being depreciated. Property class- 7 years Date placed in service- 10th September 2016. Have limited useful lives.

A change in the estimate of the useful life of equipment requires. A retroactive change to the amount of periodic depreciation applied to. No change in the periodic depreciation.

Apply straight-line depreciation to the assets based on average service lives of the assets. Because land is assumed to have an unlimited useful life it is not devalued. By definition which of the following are not capital assets.

The system will not display an asset for depreciation calculation if any of the following apply. Therefore the costs of those assets must be. Check all that applyAt the end of the assets useful life its Accumulated Depreciation will equal the assets depreciable cost book or carrying value will equal the assets residual value Accumulated Depreciation will equal the.

A residual value. An increase in annual income. Answer- Option A and E not depreciableIe Land and Inventory.

Depreciation rate - 1429. Land is not a depreciable asset.

Solved The Difference Between The Cost Of A Depreciable Chegg Com

Assets That Can And Cannot Be Depreciated Accountingo

Depreciation Bookkeeping Business Accounting Education Accounting Classes

What Is An Asset S Depreciable Basis Accounting Services

Depreciation Selling A Depreciable Asset Accountingcoach

Solved Question 1 1 Point Factors To Consider In The Chegg Com

Assets That Can And Cannot Be Depreciated Accountingo

Chapter 05 Test Bank Chapter 05 Student Studocu

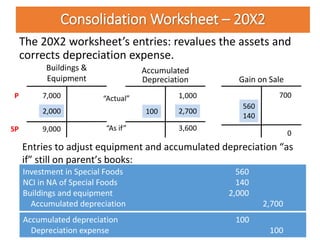

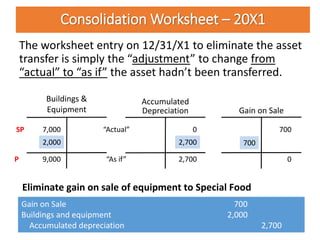

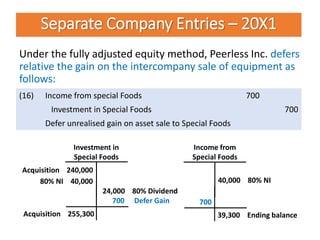

Intercompany Transactions Of Non Current Assets Depreciable Assets

Intercompany Transactions Of Non Current Assets Depreciable Assets

Intercompany Transactions Of Non Current Assets Depreciable Assets

1231 1245 And 1250 Property Used In A Trade Or Business Investing Infographic Investment Quotes Investing

Solved Which Of The Following Is A Non Depreciable Asset Chegg Com

Assets That Can And Cannot Be Depreciated Accountingo

Intercompany Transactions Of Non Current Assets Depreciable Assets

Assets That Can And Cannot Be Depreciated Accountingo

Solved Land Is Not A Depreciable Asset Because Select One O Chegg Com

Financial Statement Template Check More At Https Nationalgriefawarenessday Com 917 Financial Statement Template Profit And Loss Statement Financial Statement

Intercompany Transactions Of Non Current Assets Depreciable Assets

Comments

Post a Comment